MDM for Financial Institutions

Moki’s mobile device management (MDM) solutions for financial institutions offer a robust platform to manage mobile devices, improve customer engagement, and enhance operational efficiency.

Why MDM is Essential for Financial Institutions

As the use of mobile devices in our everyday lives continues to proliferate, the same goes for mobile device use in banking and finance services. With mobile devices in banking, customers can gain quick access to their bank accounts, make transactions, and receive notifications. However, without the convenience of an effective MDM solution, financial institutions face the following pitfalls:

-

Reliance on paper-based transactions

-

Lack of Security Measures

-

Inconsistent customer experience

-

Device updates & troubleshooting consume time and resources

Experience the Benefits of a Robust MDM Solution

Customers expect quick and efficient services from their banks or credit unions, and a robust MDM solution can help financial institutions meet these expectations while also providing numerous other benefits, including:

Greater Security

MDM solutions in banks gain enhanced mobile device security through features such as device lockdown. This not only protects devices against unauthorized use, but it also helps to protect customers’ financial data.

Enhanced Customer Experience

Digitized transactions and paperless processes offered by MDM solutions can improve the overall customer experience, making it more convenient and efficient for customers to conduct their banking activities.

Time and Cost Savings

Financial institutions can save time and resources by automating device updates and troubleshooting tasks. This reduces the need for IT support, allowing staff to focus on more critical tasks.

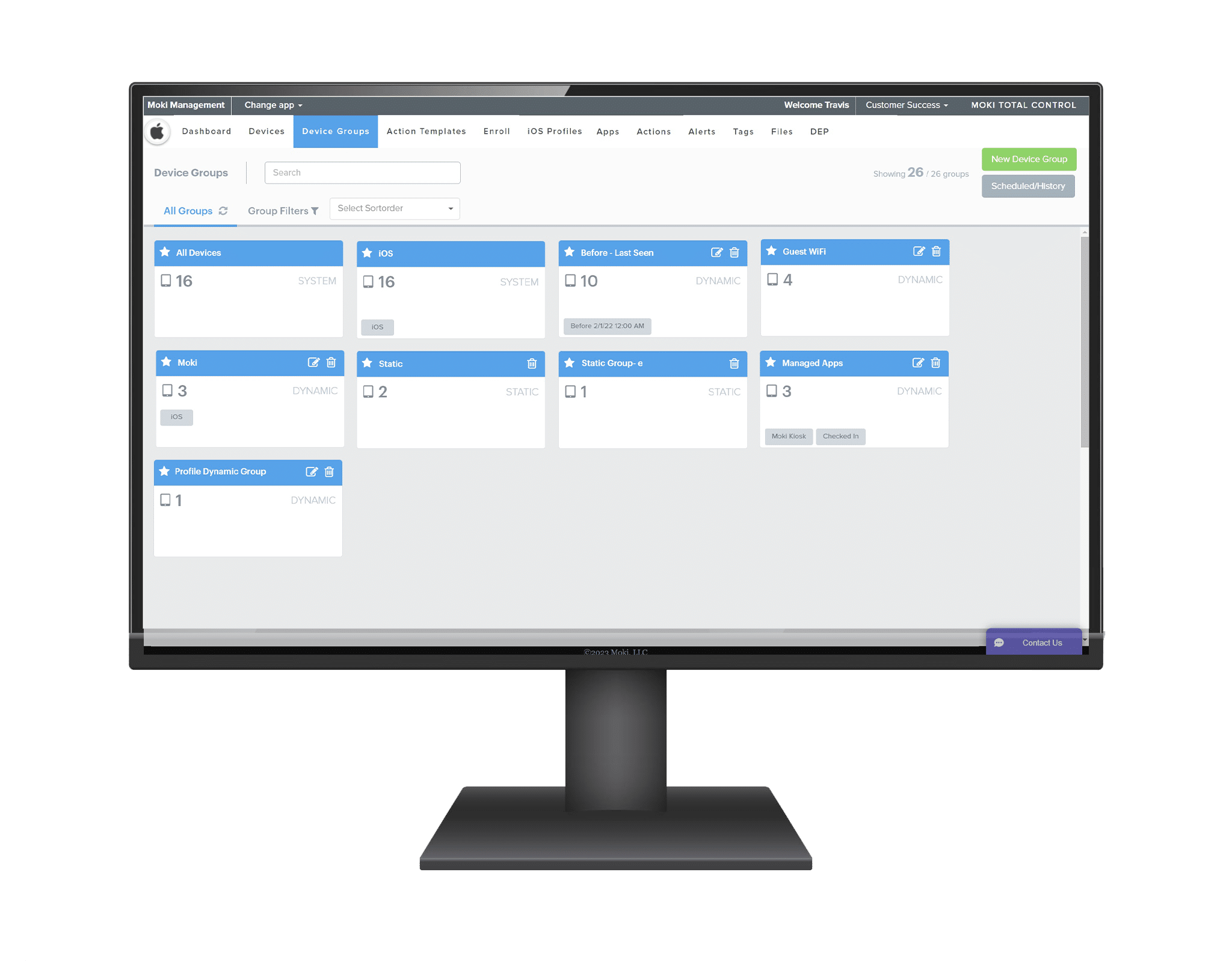

Remote Device Updates, Troubleshooting & Deployment

With MDM solutions, financial institutions can remotely update and troubleshoot devices, reducing the need for manual intervention and saving time and resources. This also allows for faster deployment of new features or services to customers.

"The Moki Team Has Been Crucial In Working Through Issues When They Arise And Also Adding New Features That Enhance The Overall Value Of The Moki Platform To Our Business."

– MoneyGram

Who We Serve

Moki helps numerous types of financial businesses streamline their mobile device management, including:

Banks

Credit Unions

Lenders

Financial Service Providers

Seamless Customer Interactions at Banks, Credit Unions & More

Optimize digital interactions at your bank or credit union with Moki’s MDM solution.

Moki’s Solutions for Financial Institutions provide an all-encompassing solution for securing sensitive data and preventing security breaches. With remote management capabilities, financial institutions can efficiently manage multiple devices from a centralized location, saving money and time. Our comprehensive MDM solutions ensure seamless updates, configurations, and content management, allowing you to stay ahead of the curve.

MDM Use Cases in Financial Institutions

MDM solutions are used for a variety of purposes in financial institutions, such as:

- Loan applications

- Securing sensitive customer data on mobile devices

- Self-checkout & payment processing

- Bill paying

- Sending or withdrawing money

- Automating device updates and troubleshooting

- Tracking and managing mobile devices used by employee

Contact Moki for Tailored MDM Solutions

By providing a comprehensive and customizable MDM solution, Moki caters to the specific needs of each type of financial institution, ensuring efficient and secure operations. So whether you are a small community credit union or a large bank, Moki has the right solution for your mobile device management needs.